-

Budapest weather

-1 °C

-1 °C

Invest in PROperty!

Economic Data Favour Budapest!

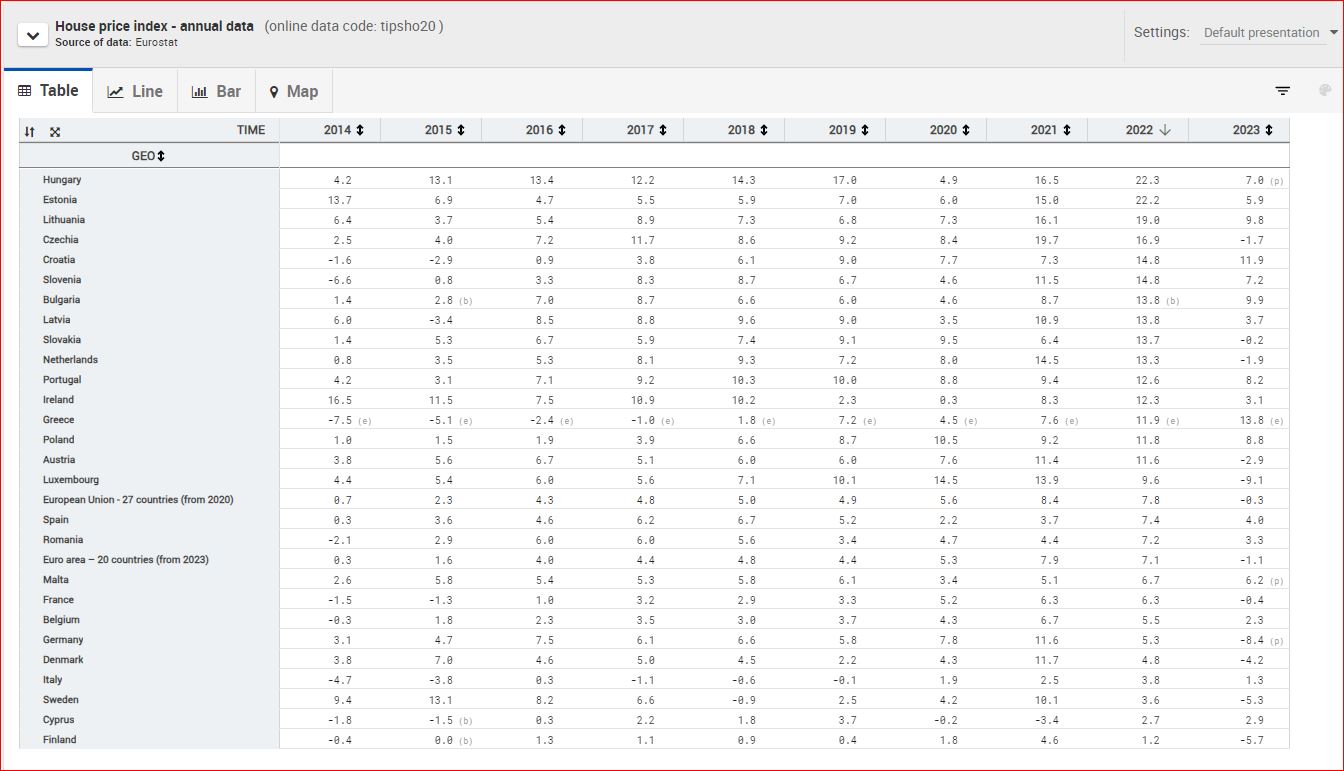

Investing in real estate or relocating to Budapest presents significant economic advantages for foreigners. Hungary has shown robust economic growth, with GDP rising from $130 billion in 2008 to over $213 billion in 2023, with an average annual growth rate of around 3-4%. Notably, GDP growth rebounded to 7.1% in 2021 post-pandemic.

The Budapest Real Estate Market

The Budapest Real Estate Market

- Price Increase: Over the last five years, property prices in Budapest have grown by 8-12% annually. In 2023, the average price per square meter reached €2,700, up from €1,800 in 2018.

- High Demand: Factors like foreign investment, low interest rates and government incentives have driven demand, leading to over 25,000 transactions in 2022.

- Rental Yields: Averaging around 5%, these yields remain attractive for investors.

- New Developments: About 5,000 new units were completed in 2023, reflecting ongoing development.

- Government Policies: Supportive measures like subsidies and favourable mortgage terms have sustained market growth.

- The Prime Location real estate segment has seen particularly strong growth, with high-end properties in central Budapest appreciating at an annual rate of 10% or more.

- Looking ahead, analysts project that Budapest's real estate market will continue to grow, though at a potentially slower pace, with expected annual price increases of around 5% to 7% over the next few years.

Trends in 2024

- Property Prices: The average price per square meter in Budapest has risen to approximately €2,850 from €2,700 in early 2023. This represents an average annual growth rate of about 5.5% for the first half of the year.

- Transaction Volume: Over 13,000 transactions were recorded in the first half of 2024.

- Rental Yields: Holding steady at 5.1%.

- New Developments: 2,700 new units were completed, up from 2,500 in the same period last year.

- Foreign Investment: International buyers accounted for 20% of new acquisitions.

- Luxury Segment: High-end property prices grew by 8%.

- District Variations: Central areas saw a 7% price increase, outer districts 3-4%.

Analysis of Premium Property Prices in Budapest (2019-2024)

- Overview: The 5th District is renowned for high-end properties and landmarks like the Danube River and Parliament Building.

- Price Trends:

- 2019-2020: Prices rose from HUF 1,200,000 - HUF 1,500,000 to HUF 1,300,000 - HUF 1,600,000 per square meter.

- 2021: Further increase to HUF 1,400,000 - HUF 1,700,000 per square meter.

- 2022: Prices reached HUF 1,500,000 - HUF 1,800,000 per square meter.

- 2023-2024: Stabilized around HUF 1,600,000 - HUF 1,900,000, with the current range at HUF 1,700,000 - HUF 2,000,000 per square meter.

- Key Influences:

- Location: Central position and proximity to landmarks.

- Economic Conditions: Inflation and interest rates impact future trends.

- International Interest: Consistent demand from foreign investors.

- Pandemic Effects: Minimal long-term impact on property prices.

- Future Projections: Prices are expected to grow steadily, though economic uncertainties may affect the rate of growth.

Key Economic Data

To analyze the real net appreciation of Budapest property prices over the past five years in terms of both USD and EUR, we need to consider the following factors:

-

Property Price Trends in Budapest (2018-2023):

- In general, Budapest has seen a notable increase in property prices over the past five years. Data from various real estate reports indicate that property prices have risen significantly, with an annual average increase of around 8% to 12%.

-

Currency Exchange Rates:

- EUR/USD Fluctuations: Exchange rates between the Hungarian Forint (HUF) and major currencies like the Euro (EUR) and US Dollar (USD) have fluctuated over these years, which impacts the nominal value of property prices in foreign currencies.

- For instance:

- 2018: 1 EUR ≈ 320 HUF, 1 USD ≈ 270 HUF

- 2023: 1 EUR ≈ 390 HUF, 1 USD ≈ 355 HUF

-

Conversion to USD and EUR:

-

To assess real net appreciation, property price trends in HUF must be converted into EUR and USD for each year, considering the exchange rate changes.

-

Example Calculation:

- 2018 Average Property Price: HUF 500,000/sqm

- 2023 Average Property Price: HUF 750,000/sqm

Converting to EUR and USD:

- 2018:

- EUR: 500,000 HUF / 320 = €1,562.50/sqm

- USD: 500,000 HUF / 270 = $1,851.85/sqm

- 2023:

- EUR: 750,000 HUF / 390 = €1,923.08/sqm

- USD: 750,000 HUF / 355 = $2,113.28/sqm

-

-

Analysis of Real Net Appreciation:

- EUR-Based:

- From €1,562.50/sqm in 2018 to €1,923.08/sqm in 2023.

- Increase: (€1,923.08 - €1,562.50) / €1,562.50 ≈ 23.1%

- USD-Based:

- From $1,851.85/sqm in 2018 to $2,113.28/sqm in 2023.

- Increase: ($2,113.28 - $1,851.85) / $1,851.85 ≈ 14.1%

These increases indicate nominal appreciation. However, to determine the real net appreciation, we should adjust for inflation and other economic factors.

- EUR-Based:

-

Inflation Adjustment:

- Hungarian Inflation Rates: If inflation rates are high, they might offset some of the nominal gains. For example, if inflation was around 2-3% per year on average, the real appreciation would be somewhat less than the nominal increases.

-

Conclusion:

- In EUR: The real net appreciation of property prices in Budapest shows a clear increase of around 23.1% over five years, suggesting significant value growth when measured in Euros.

- In USD: The real net appreciation is approximately 14.1% over the same period, indicating strong growth in terms of USD as well.

This analysis demonstrates that Budapest property prices have appreciated in both EUR and USD terms over the past five years, with a higher appreciation when measured in EUR. While the nominal increases are substantial, real net appreciation would need to account for inflation and other economic conditions to provide a complete picture.

Calculation of Personal Income Tax on Real Estate Sales in Hungary:

- Tax Rate and Holding Period:

- In Hungary, the capital gains tax rate is 15%. However, the amount of capital gain considered taxable depends on the holding period of the property.

- Taxable Income Calculation:

- Revenue: Typically includes the sale price, value of any exchanged property, and interest paid by the buyer.

- Costs: Deductible costs include documented expenses related to the acquisition and maintenance of the property, such as the purchase price, transaction fees (e.g., stamp duty, legal fees), and costs for improvements. These must be supported by receipts or invoices.

- Reduction Based on Holding Period:

- The percentage of the gain considered taxable depends on the number of years the property was held before sale.

- No Taxable Income After Five Years:

- If the property is sold after holding it for five years or more from the acquisition date, no taxable income is generated. Thus, the gain from such a sale is tax-exempt.

- Example Calculation:

- Suppose a property was purchased for HUF 10,000,000 and sold five years later for HUF 15,000,000. The calculated gain is HUF 5,000,000.

- If sold in the fifth year or later, no tax is due, as the percentage of the gain subject to tax is 0%.